THIS POST INCLUDES:

1. Types of Financial information

2. Developing a financial system

3 Using your business financial information

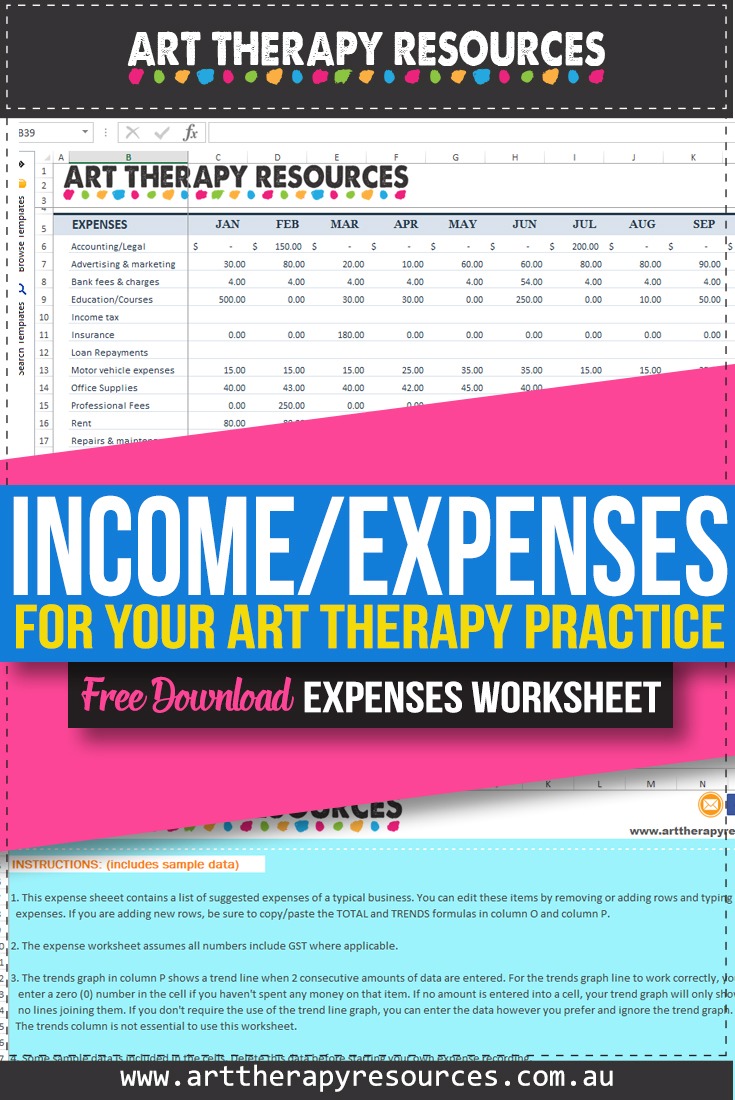

4. FREE DOWNLOAD Expenses Worksheet

TYPES OF FINANCIAL INFORMATION

DISCLAIMER: You should seek advice from your accountant or finance professional when implementing a system to record your financial information. Your accountant may be able to provide you with a template to help you record the information they need from you for tax purposes. Your accountant will also let you know what financial information is required for the specific tax laws in your region.

As an art therapist you may have had dreams of opening your own private practice, however, your education and training was most likely focused only art therapy and not about operating a private practice.

If you do operate your own private practice you will quickly learn that financial and administrative tasks are a large part of your daily obligations to running a private practice business correctly.

Most importantly as a therapist, you need to record financial information about your private practice that will determine your tax obligations.

In addition to these tax obligations, financial information can also provide you with details about the financial health of your therapy practice.

This information allows you to analyze income and expenses and make decisions that will help improve your financial position.

Some of the financial information you will need to record is:

- Income

- Expenses

- Assets – furniture, equipment, property etc

- Liabilities – loans, leases

- Salary

- Superannuation

- Taxes

- GST (Sales tax equivalent)

Setting up your financial systems involves initially recording information and flows through to ensuring you meet your taxation obligations.

The key to managing your financial information is to establish a strong recording system from the start. Your software should record data as well as provide you with useful reporting that will enable you to make decisions about your business.

Ideally, your financial system will interact with external sources including your accountant, your bank and the government for taxation purposes.

The more your financial process can be automated means the less time you spend on admin and the more time you can spend on clients.

Setting up your financial system takes some effort in the initial phase, however, once you have your systems in place, you can reasonably rely on them to work without too much intervention from yourself.

Financial considerations you will need to explore include:

- Insurances

- Software for recording income and expenses

- Paying a salary (to self)

- Payroll and income tax

- Superannuation (retirement savings for other countries)

- Client payment methods – cash, credit card etc

- Registering for ABN and GST (relevant business registrations in other countries)

- Producing invoices/receipts for clients

- Business bank account

- Payment from 3rd party groups, eg. Insurance, Medicare etc

TYPES OF EXPENSES:

Below are some of the most common expenses you can legitimately claim as part of your business operating expenses. The common rule in deciding whether a cost is deductible is to ask yourself if the expense is related to generating your business income. The information that you are required to record may vary based on your location.

EDUCATION:

- Books

- CD’s/DVD’s

- Digital downloads (ebooks, audio, video)

- Conferences

- Continuing Education

- Professional Magazines or Journals

- Online courses

- Seminars/Workshops/Webinars

CLIENT SESSIONS:

- Art supplies

- Games

- Play Therapy Tools

- Toys

- Therapy equipment

- Recording equipment

- Whiteboard/blackboard

PROFESSIONAL:

- Liability Insurance

- License Fees

- Professional Memberships

MARKETING:

- Advertising

- Business Stationery

- Email List Service

- Marketing materials (eg logo)

- Networking Events

- Online Therapist Directories

- SEO costs

- Social media agency fees

- Video/Audio equipment

OFFICE EXPENSES:

- Bank fees

- Computer, Tablet, Printer, Copier, Fax

- Credit Card Processing Fees

- Internet

- Home Office (pro rata)

- Office Furniture

- Office Rent

- Office Supplies

- Phone

- Postage

- O. Box

- Software

- Subscription

- Utilities

- Website Hosting Fees

SERVICES:

- Accounting Fees

- Business Coaching

- Legal Fees

- Search Engine Optimization Costs

- Web Design

TRAVEL:

- Business travel

- Parking

- Tolls

- Train/Bus Fare

*Note that travel costs are claimable in accordance with the tax laws within your country. Travel expenses from home to work are generally not deductible. Traveling between workplaces and to professional events are typically deductible.

DEVELOPING A FINANCIAL SYSTEM

The key to recording your financial data efficiently and effectively is to establish systems that make recording data easy. The easier your system is, the more consistent you will be in following the steps you need to take.

Your system should be simple to understand and easy to implement so that you ensure a higher compliance rate of sticking to your system.

IMPLEMENT POLICIES AND PROCEDURES

The system you set up to manage your financial data will eventually become part of your policies and procedures. By establishing policies and procedures this provides you with a step by step process to complete your financial recording. This also means you can provide your policies and procedures to future staff members to follow as your private practice grows.

Develop your procedures using checklists to be completed on a regular basis – daily, weekly, monthly, quarterly and annual tasks. If you do tasks once a year you may forget how to do them each year. It is helpful to record yourself doing the task so you can review the recording each year and complete the task without relying on your memory.

HOW OFTEN TO RECORD YOUR DATA

The first decision to make is how often to record your financial information. Some practitioners leave their business finances until the one time of the year when tax returns are due. By leaving it until this stage you will need to sort through an entire year of data which will be time consuming and lead to frustration. This can also lead to errors when you have to rely on your memory about specific transactions throughout the year.

Your main time options to record your data are:

- Annual

- Quarterly

- Monthly

- Weekly

- Daily

You will need to summarise your data annually, however, recording data annually is not a good idea. Some practitioners may choose to record their data quarterly in line with tax obligations such as BAS statements (Australia). Quarterly recording will meet your obligations, however, it still is a long time to not pay attention to your financial information.

The most common timeframe for recording financial information is monthly. A monthly timeframe is not too overwhelming given you only need to do it 12 times a year. It’s also a short enough timeframe to give you insight into the current financial position of your private practice so that you can make any changes to your income and expenses.

The more immediate timeframes of weekly and daily will ensure the financial information of your private practice remains up to date so that you instantly have an accurate assessment of the financial health of your business.

Weekly and daily financial record keeping may be onerous to a single private practitioner, however, it is easily attainable if you have an administrative staff member to help maintain your records. It is also attainable if you choose to do it yourself.

The frequency of how regularly you record your financial information is significantly impacted by how easy your recording process is developed. For example, if you maintain only one bank account and funnel or income and expenses through one account then you only have one source of financial data to manage.

Conversely, if you have multiple accounts, a PayPal account, a credit card account, and other various sources of receiving money, then this requires managing multiple entry points of data that all need to balance back to a central financial position. This layered approach of multiple accounts can take time to access, export, balance, and maintain.

The simpler your system is, the less time it will take to manage your information. Fortunately for current technology users, even if you do have multiple accounts, most vendors have integrative processes that enable you to share your financial information across multiple portals. This can help you seamlessly integrate your data without too many manual processes.

FINANCIAL RECORDS METHODS:

You can record your financial methods using a variety of different methods including:

- Paper and pen (using a financial journal)

- Spreadsheet (using templates provided for free by Microsoft/Apple)

- Desktop software (Quickbooks, MYOB etc)

- Mobile apps

SAVING RECEIPTS AND FINANCIAL PROOF

Even though your private practice bank account records your financial information, you also have obligations to save receipt that will substantiate your data. This includes keeping invoices that you generate for client work as well as invoices that you receive when making purchases.

For purchases, many people take the shoebox approach where all receipts are stored inside a shoebox and retrieved when needed. For a more formal system, you can use a filing cabinet. Alternatively, if you prefer to rely on digital storage, you can also scan or take a photo of your receipt and save it to your computer hard drive or in electronic software such as Evernote.

For the process of recording your financial information, using receipts is mainly relevant if you operate a bank account that is a mix of personal and business transactions. Using receipts will help you identify which transactions are business. This method of mixed personal and business transactions from one account is not recommended as it takes more work for you to identify what is business related.

If you keep one single business account then you don’t need to refer to your receipts to record financial information as you can safely assume all transactions within your business bank account are business related. Most banking systems record enough information to determine what type of cost an item is, however, if you spend $1,000 in one store, you will need your receipt to determine what items are immediate expense write-offs and what items may be assets to depreciate (write off) over time.

The length of time and amount of information to keep will depend on your region. Most financial information needs to be kept for at least 5-10 years depending on where you live.

Considering the volume of paperwork that you will accumulate in this time period, it’s a good idea to try and implement an electronic recording system where possible. Always ask the business for an electronic copy of your receipt or invoice where possible. If you receive a physical invoice or receipt you can scan the document or take a photo using the camera on your phone. You can then store the image on your computer either in a program on Evernote or directly on your computer. Just make sure to name your image with a useful name so that you can easily search for the copy if you need to later.

It’s best to save your electronic data according to the financial year as this is the method that is most commonly used in business.

USING YOUR BUSINESS FINANCIAL INFORMATION

Once you have developed your financial systems to record your financial information, you may wonder what you can do with this collected information.

Your financial information is primarily recorded for tax obligations. Your financial records can be provided to your accountant to prepare your tax accounts.

In addition to your tax obligations, you can also use your financial information to help make informed decisions about your business and how it operates.

By regularly reviewing your financial information, you can make business decisions about your income and expenses to help improve your profit. Regularly reviewing your financial information enables you to make timely decisions about necessary changes. If you only review your financial information once a year at tax time you may find yourself in a position where you owe a large amount of tax that you hadn’t planned for.

For more blog posts about managing your financial information in your practice visit the below links:

FREE DOWNLOAD: Expenses Worksheet

BUILD YOUR ART THERAPY REFERENCE MATERIALS:

Pin this image to your Pinterest board.

SHARE KNOWLEDGE & PASS IT ON:

If you’ve enjoyed this post, please share it on Facebook, Twitter, Pinterest. Thank you!