THIS POST INCLUDES:

1. Foundations of Cash Flow Planning

2. Creating your Weekly Cash Flow Plan

3. Using your Weekly Cash Flow Plan

4. Free Download Cash Flow Template

FOUNDATIONS OF CASH FLOW PLANNING

DISCLAIMER: You should seek advice from your accountant or finance professional when implementing a system to record your financial information. Your accountant may be able to provide you with a template to help you record the information they need from you for tax purposes. Your accountant will also let you know what financial information is required for the specific tax laws in your region.

As an art therapist, you may be running your own private practice or have aspirations of establishing your own private practice. Nevertheless, it’s essential to recognize that your education and training have likely centred on the art therapy field, with little emphasis on the administrative requirements of operating a private practice.

If you are managing your own private practice, you will soon realize that financial and administrative responsibilities play a substantial role in the day-to-day operations of running a private practice business effectively.

In this blog post, we are looking at the concept of a weekly cash flow plan for therapists managing their private practice. This blog post aims to provide you with some understanding of how you can operate your private practice with more financial stability through a cash flow plan.

Before delving into the specifics, let’s establish a clear understanding of what a cash flow plan entails and why it holds great significance for therapists operating their private practices.

What is Cash Flow Planning?

Cash Flow Planning is a vital financial management practice that allows individuals and businesses to keep a close eye on the movement of money in and out of their accounts. It serves as a financial roadmap, guiding you through the ebbs and flows of your income and expenses. The main objective of Cash Flow Planning is to ensure that the inflow of funds is sufficient to cover all necessary expenditures and maintain a healthy financial balance.

The Components of Cash Flow Planning

1. Anticipated Income: At the core of Cash Flow Planning is a thorough examination of the income you expect to receive. This includes all sources of revenue, such as client fees, insurance reimbursements, and any additional income streams related to your therapy practice.

2. Projected Expenses: Equally crucial is a comprehensive overview of your expected expenses. This includes all costs associated with running your therapy practice, such as rent, utilities, office supplies, marketing expenses, and professional development fees. By projecting your expenses, you can allocate funds appropriately and avoid unexpected financial challenges.

3. Budgeting: Once you have a clear picture of your anticipated income and projected expenses, the next step is to create a budget. A budget is a financial plan that outlines how you will allocate your funds to cover various expenses and achieve specific financial goals. Budgeting is a proactive approach that allows you to prioritize spending and manage your finances efficiently.

4. Monitoring and Analysis: A significant aspect of cash flow planning involves monitoring your actual cash flow against your projected figures. Regularly tracking your income and expenses allows you to identify any deviations from your plan and make necessary adjustments. Analyzing your cash flow data empowers you to gain insights into your financial performance and make informed decisions moving forward.

Why Cash Flow Planning Matters

As a therapist managing a private practice, financial management is essential to the success of your practice. This benefits your clients because it means you are improving the chances of your practice surviving and flourishing. Cash flow planning acts as a lifeline that sustains your business during fluctuating financial periods. Cash flow planning empowers you to proactively address financial challenges as well as provide an insight into how your business can invest in future growth and success.

As a therapist managing your own private practice, cash flow planning holds immense importance for several reasons:

1. Financial Stability: cash flow planning helps maintain a stable financial environment for your practice. With a clear understanding of your income and expenses, you can ensure that you have enough funds to cover essential business costs and avoid cash flow shortages.

2. Proactive Decision-Making: Having a well-structured cash flow plan allows you to make proactive financial decisions. Whether it’s investing in new equipment, expanding your services, or hiring additional staff, your cash flow insights guide you in making prudent choices for your practice’s growth.

3. Risk Mitigation: By monitoring your cash flow regularly, you can identify potential financial risks early on and take preventive measures. This proactive approach helps you steer clear of financial crises and ensures your practice remains resilient during uncertain times.

4. Financial Planning for the Future: cash flow planning provides the groundwork for financial planning in the long term. By having a clear picture of your financial health, you can set realistic financial goals, allocate resources efficiently, and work towards achieving your vision for your therapy practice.

The Benefits of Weekly Cash Flow Planning

Implementing a cash flow plan offers an array of invaluable benefits. This financial tool not only provides you with a clear roadmap for your practice’s financial trajectory but also allows you to identify potential financial gaps in advance. Through regular monitoring and adjustment, this plan nurtures financial discipline and fosters prudent financial management which is critical for the sustained growth of your private practice.

As mentioned previously cash flow can is important as it helps create financial stability for your practice. Additionally, it can also help with better decision-making with regard to financial matters within your practice.

Cash flow planning can help your business thrive and grow, however, it can also help you avoid the negative aspects of business financial management. Cash flow planning helps improve debt management to help you develop strategies to pay off debts on time, avoid high-interest charges, and improve your overall financial health. Furthermore, it can help prevent a potential financial crisis when you can identify potential financial issues early on and take corrective actions. This proactive approach helps prevent financial crises and minimizes the risk of encountering cash flow problems.

Cash flow planning provides the groundwork for achieving long-term financial goals. By analyzing your cash flow trends, you can set realistic financial targets, save for future investments, and work towards achieving financial independence.

While cash flow planning in itself is beneficial, adopting a weekly approach can further enhance its effectiveness. Weekly cash flow planning offers unique advantages, especially for businesses with fluctuating income and expenses, such as therapists running private practices.

Through consistent monitoring, you are using a shorter time frame of cash flow analysis where you can identify cash flow patterns and trends quickly which provides you with more time to respond to any changes.

Weekly planning enables you to allocate resources with better accuracy. By breaking down your monthly projections into weekly segments, you can proactively allocate funds to cover expenses and prioritize essential aspects of your practice.

A weekly approach enhances your ability to adapt to unforeseen circumstances. If there are any unexpected changes in your cash flow, you can quickly adjust your plan for the coming week, ensuring continued financial stability.

With weekly cash flow insights, you have a real-time understanding of your financial situation. This empowers you to make dynamic decisions as situations arise, rather than relying solely on a monthly or annual overview.

A weekly planning approach provides more data points for cash flow forecasting. This increased insight enables you to refine your projections and make more accurate financial predictions for the future. For therapists managing their private practices, weekly cash flow planning can be particularly useful in navigating the dynamic nature of their income and expenses, ultimately leading to better financial management and business success.

NOTE: It’s important to note some differences between creating formal financial statements for your business compared to creating functional management tools to help manage your business financial transactions.

Formal financial statements include:

- Profit and Loss Statement

- Balance Sheet

- Cash Flow Statement

These financial documents are typically generated by software with the input of a bookkeeper, accountant, or tax professional. These statements often reflect a more complete picture of the financial position of your business that meets regulatory and legislative requirements.

The cash flow PLAN we are referring to in this blog post does not include some of the regulatory requirements that formal financial statements provide. Our cash flow PLAN provides a quick and efficient snapshot of the cash flow position of your business over the next few 7 days (and beyond if you prefer). It helps you make immediate decisions about whether you can meet financial obligations over the next 7 days, and whether you may have excess cash available to invest in planned business activities.

CREATING YOUR WEEKLY CASH FLOW PLAN

Before creating your weekly cash flow plan, you should collate some information to help enter data. This information may require access to your business bank account and any past invoices.

Identifying Your Income Sources

As you embark on the journey of creating your Weekly Cash Flow Plan, the first and most vital step is to identify all your income sources. As a therapist managing your private practice, your income may stem from various streams, and understanding each source is crucial for constructing an effective cash flow plan. Careful and meticulous identification of all revenue streams is the key to gaining a comprehensive understanding of your cash inflows and ensuring accurate financial tracking.

Categorizing Your Revenue Streams

Begin by listing all the sources from which you generate income. These may include:

- Client Sessions: The fees you charge for therapy sessions are likely to be one of the primary sources of income for your private practice.

- Insurance Reimbursements: If you work with insurance companies, reimbursements for services provided to clients will form a significant portion of your income.

- Workshops and Trainings: If you offer workshops, training sessions, or educational programs related to your expertise, these can be additional revenue sources.

- Online Offerings: If you offer online services, such as virtual therapy sessions or digital products, these too are essential income streams.

- Subcontracting or Consultation Work: Income earned from subcontracting or consultation services you provide to other professionals in the field.

- Grants or Funding (if applicable): If your practice receives grants or funding from organizations or institutions, these contribute to your income.

- Other Income Streams: Any other sources of income specific to your practice.

Understanding the Significance of Categorization

Categorizing your income sources serves several purposes in the context of your Weekly Cash Flow Plan:

- Clarity and Accuracy: By breaking down your income into distinct categories, you gain a clear understanding of the various streams contributing to your practice’s revenue. This clarity ensures that no income source is overlooked, and all income streams are accurately accounted for.

- Segmenting and Prioritizing: Categorization enables you to segment your income sources based on their significance. You can prioritize high-impact revenue streams and develop strategies to strengthen or expand them.

- Identifying Trends: Analyzing your income categories over time allows you to identify trends and patterns in your earnings. This insight can help you anticipate fluctuations and plan accordingly.

- Budget Allocation: Categorization facilitates budget allocation. You can allocate funds to cover specific expenses based on the income categories they relate to, ensuring a balanced cash flow. For example, if you plan for income being sourced from subcontracting work at a hospital, this may trigger you to record any corresponding expenses such as parking fees or tolls for your trip to the hospital.

- Future Planning: Categorization lays the foundation for future financial planning. Understanding the relative contributions of each income stream can aid in setting realistic financial goals and forecasting future revenue.

Identifying and categorizing your income sources is an essential starting point in constructing an effective Weekly Cash Flow Plan. This foundational step provides you with a comprehensive overview of your cash inflows, enabling accurate financial tracking and informed decision-making.

Tracking Your Expenses

As a therapist running your own private practice, staying on top of your financial commitments is paramount to ensure a thriving and stable business. One crucial aspect of financial management is tracking your expenses diligently. By tracking your expenses, you gain invaluable insights into your spending patterns, which can lead to informed financial decision-making and prudent allocation of resources.

The Importance of Expense Tracking

Tracking your expenses offers several significant benefits for your private practice:

1. Financial Visibility: With expense tracking, you gain a clear and comprehensive view of where your money is going. This visibility enables you to identify areas where you may be overspending or areas where you can potentially save, allowing you to optimize your practice’s financial health.

2. Budget Management: By recording and categorizing your expenses, you can create a well-structured budget that aligns with your practice’s income. A budget acts as a financial roadmap, guiding you on how to allocate funds to different aspects of your business effectively.

3. Informed Decision-Making: Having accurate expense data at your fingertips empowers you to make well-informed financial decisions. Whether it’s considering new investments, expanding your services, or cutting costs, having a clear understanding of your expenses provides the necessary information to make prudent choices.

4. Expense Control: Regular expense tracking allows you to implement effective cost-control measures. By identifying areas where expenses can be reduced or optimized, you can maximize the efficiency of your practice’s financial resources.

The Process of Expense Tracking

Implementing a systematic approach to expense tracking is essential for its effectiveness. Here’s a step-by-step process to get you started:

1. Create Categories: Begin by creating categories for your expenses. Common categories include rent, utilities, office supplies, marketing, professional development, and any other significant expenses specific to your practice.

2. Record Every Expense: Make it a habit to record every expense, no matter how small. Whether it’s a purchase for office supplies or a fee for attending a professional workshop, keeping a detailed record is crucial.

3. Choose a Tracking Method: Decide on a tracking method that works best for you. You can use traditional pen and paper, spreadsheets, or expense tracking apps available on various devices. NOTE: Check out our previous blog post: How to Record Income and Expenses for your Art Therapy Practice

4. Regular Updates: Update your expense records regularly. Weekly or monthly updates are recommended to maintain accurate and up-to-date financial data.

5. Analyze and Adjust: Regularly review your expense data and analyze spending patterns. Use this information to adjust your budget and identify areas where you can make improvements.

Tracking your expenses is an essential practice for any therapist managing their own private practice. You gain valuable insights into your spending habits and financial commitments. This financial visibility empowers you to make informed decisions, optimize your budget, and take control of your practice’s financial health.

Projecting Your Cash Flow

Projecting your cash flow is a vital practice that enables you to look ahead and anticipate the ebbs and flows of your finances. This proactive approach to financial planning allows you to gain valuable insight into your available cash for the upcoming week, helping you make informed decisions and navigate potential challenges with confidence.

The primary steps involved in projecting your cash flow are below:

- Enter your starting bank balance which represents your starting point

- Collate and enter all relevant data related to income and cash coming into the business (earning)

- Collate and enter all relevant data related to expenses and cash going out of the business (spending)

- Step 1 + Step 2 – Step 3 = Your estimated ending cash flow balance

Example below:

- Starting cash balance = $500

- Income estimated to be earned for week 1 = $2000

- Expenses estimated to be spent for week 1 = $1500

- Step 1 ($500) + Step 2 ($2000) – Step 3 ($1500) = $1000 estimated ending cash balance

Using the above example, we now know that at the end of week 1, our cash flow will be $1000. You then use that balance amount to begin estimating week 2.

Adjusting and Refining Your Plan

As shown in the example above, we estimated our income, expenses and final projected cash flow. However, a weekly cash flow plan is an evolving instrument that necessitates periodic review and adjustment. As more information becomes available during your cash flow planning process, you should adjust and refine your numbers to provide a more accurate point of view.

For example, you may enter projected income of $2000 into your spreadsheet, however, you may notice a day after you entered your data, a corporate client called to inform you they are depositing $800 into your bank account at the end of the week. You simply add in that extra $800 to update your cash flow plan.

Continually monitor actual cash flow against projections, and refine the plan as required. This adaptive approach ensures the identification of potential issues early on and fosters sustained financial stability within your private practice.

USING YOUR WEEKLY CASH FLOW PLAN

Making Informed Financial Decisions

The value of making informed financial decisions cannot be overstated for therapists running their own private practice. With your weekly cash flow plan as your trusted ally, you gain the ability to assess your practice’s financial health, strategize for the future, and weather the storms that may arise. This financial compass not only helps you stay on course but also allows you to seize opportunities and embrace growth with assurance.

Armed with data-driven insights, you can confidently allocate resources, invest in your practice’s development, and cultivate a thriving business that aligns with your vision and goals. With each decision grounded in knowledge and foresight, you pave the way for lasting financial success.

Avoiding Cash Flow Shortages

Avoiding cash flow shortages is crucial for the smooth operation of your private practice. Your weekly cash flow plan plays a pivotal role in this process, serving as a proactive shield against financial uncertainty. By diligently adhering to your cash flow plan, you gain a clear understanding of your cash inflows and outflows, allowing you to identify potential gaps and take pre-emptive measures.

With the foresight provided by your cash flow plan, you can anticipate weeks with lower income and plan accordingly. This may involve adjusting expenses, rescheduling non-urgent purchases, or exploring additional revenue streams. By staying vigilant and proactive, you can maintain the financial stability of your practice.

Planning for Investments and Growth

Planning for investments and growth is an exciting phase for therapists in private practice. Your cash flow plan serves as a valuable roadmap, guiding you towards wise allocation of funds and unlocking the potential for expansion and development.

With a well-structured cash flow plan, you can identify surplus funds that can be earmarked for growth initiatives. Whether it’s investing in advanced training, upgrading your practice’s infrastructure, or expanding your services, your cash flow plan empowers you to make these decisions with confidence.

Furthermore, by setting aside funds for future investments, you can seize opportunities as they arise and position your practice for long-term success and sustainability. Embracing the potential for growth and strategic investments, you can pave the way for a thriving private practice.

Achieving Financial Stability and Success

Achieving financial stability and success is the ultimate goal for therapists running their own private practice. Your weekly cash flow plan is a key tool as it provides the structure and insights needed to navigate the financial landscape with confidence.

Consistent maintaining your cash flow plan enables you to stay on track and make informed financial decisions. As you proactively manage your cash inflows and outflows, you gain control over your practice’s financial destiny. This empowers you to allocate resources wisely, invest in growth opportunities, and build a sustainable financial future.

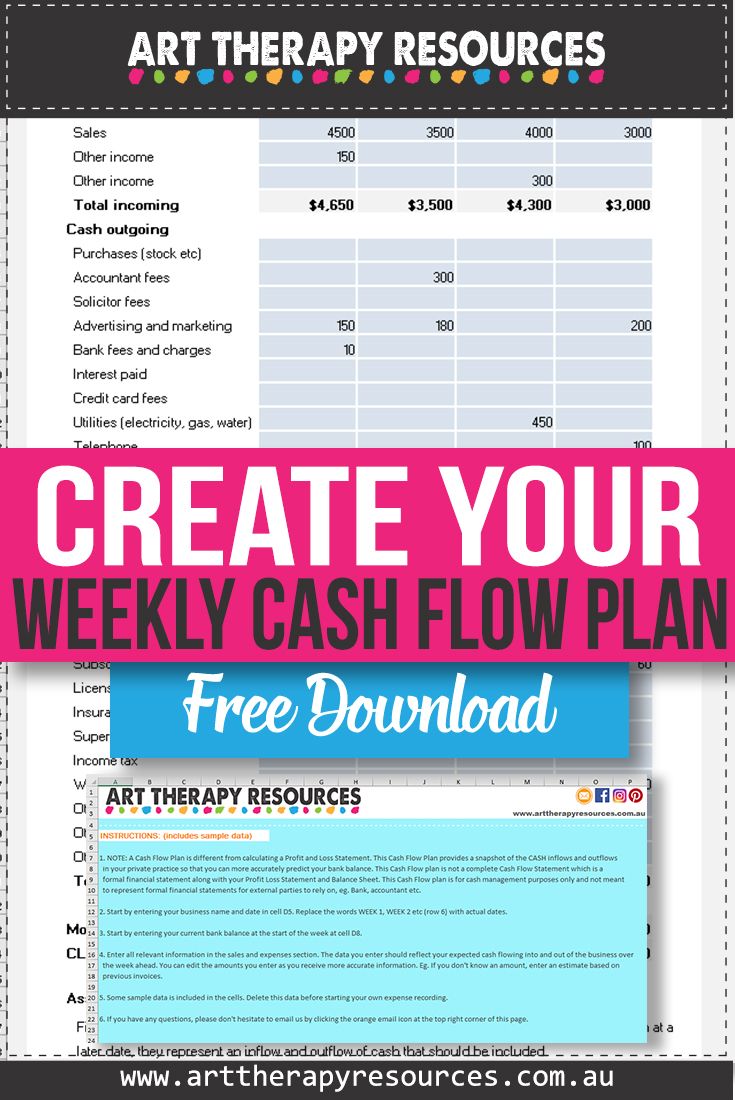

FREE DOWNLOAD

SIGN UP below to download the FREE Cash Flow Template.

BUILD YOUR ART THERAPY REFERENCE MATERIALS:

Pin this image to your Pinterest board.

SHARE KNOWLEDGE & PASS IT ON:

If you’ve enjoyed this post, please share it on Facebook, Twitter, Pinterest. Thank you!